Secure Your Tranquility of Mind With Reliable Home Insurance Coverage

Why Home Insurance Coverage Is Crucial

The importance of home insurance policy hinges on its ability to give monetary defense and satisfaction to house owners in the face of unanticipated events. Home insurance coverage acts as a security web, providing protection for problems to the physical structure of the residence, personal belongings, and liability for crashes that may take place on the property. In the event of natural calamities such as earthquakes, floodings, or fires, having a comprehensive home insurance plan can assist homeowners recoup and rebuild without encountering considerable financial burdens.

Furthermore, home insurance coverage is typically needed by mortgage lenders to protect their investment in the property. Lenders want to make certain that their economic passions are safeguarded in instance of any kind of damage to the home. By having a home insurance plan in position, house owners can fulfill this demand and safeguard their financial investment in the residential property.

Types of Coverage Available

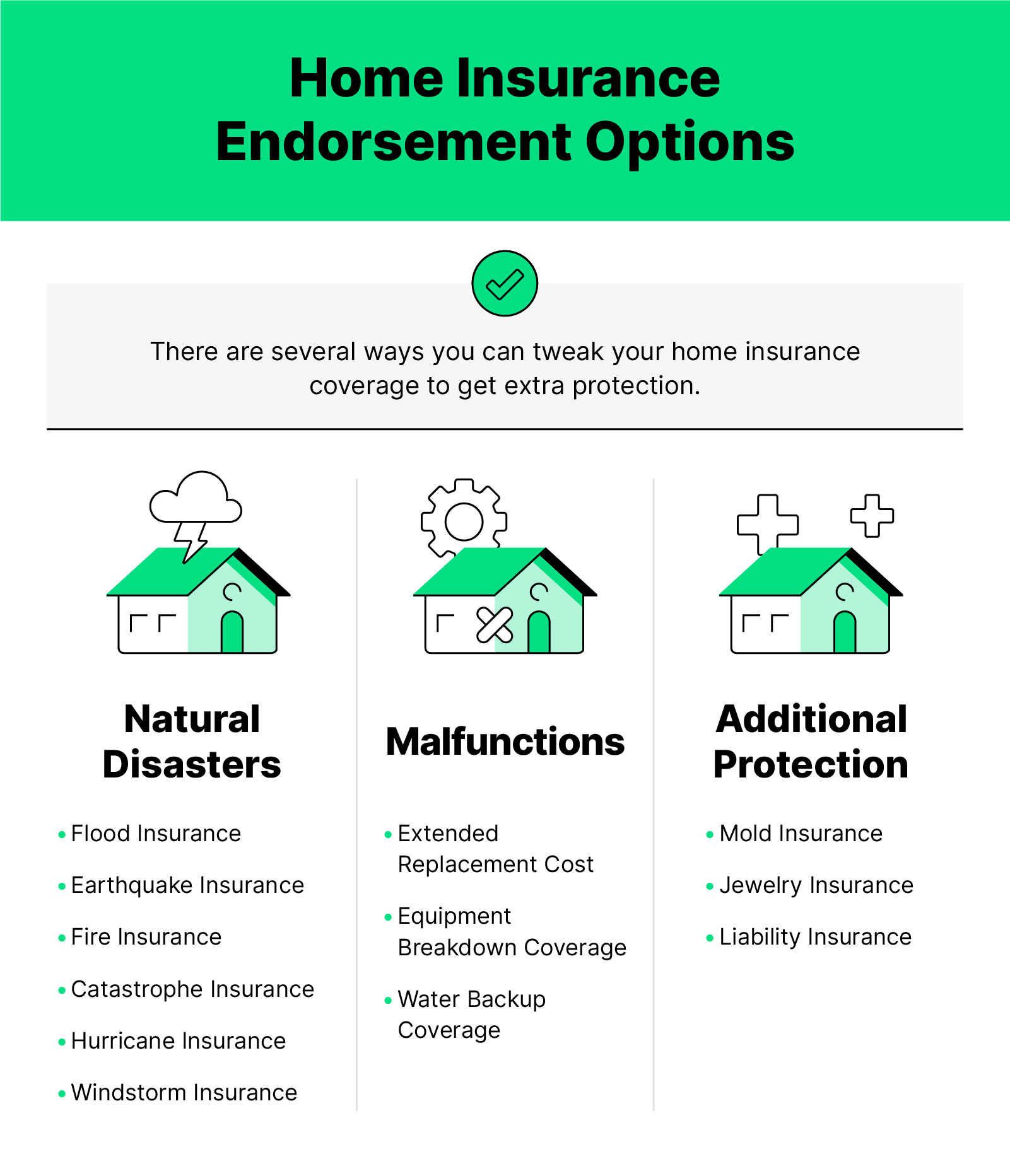

Given the significance of home insurance coverage in securing home owners from unanticipated monetary losses, it is important to comprehend the different kinds of coverage readily available to tailor a plan that fits private requirements and situations. There are numerous key types of coverage provided by most home insurance policy plans. Personal residential property coverage, on the various other hand, safeguards personal belongings within the home, including furnishings, electronic devices, and clothing.

Elements That Influence Premiums

Variables affecting home insurance coverage premiums can differ based on a variety of considerations details to specific scenarios. Older homes or residential properties with out-of-date electrical, pipes, or home heating systems might posture higher risks for insurance policy business, leading to higher premiums.

In addition, the insurance coverage limitations and deductibles chosen by the policyholder can influence the costs amount. Opting for higher insurance coverage limitations or reduced deductibles normally results in greater costs. The type of construction products utilized in the home, such as timber versus block, can also influence premiums as certain products may be much more susceptible to damages.

Exactly How to Select the Right Policy

Picking the appropriate home insurance coverage plan entails careful consideration of numerous vital aspects to make sure thorough insurance coverage customized to individual needs and scenarios. To start, assess the value of your home and its components precisely. Next off, take into consideration the different types of coverage offered, such as house insurance coverage, individual residential or commercial property protection, obligation security, and added living expenditures insurance navigate to this website coverage.

In addition, evaluating the insurer's credibility, monetary stability, client service, and declares procedure is vital. Seek insurers with a history of dependable service and prompt claims settlement. Finally, compare quotes from multiple insurance providers to discover an equilibrium in between cost and protection. By meticulously evaluating these elements, you can choose a home insurance coverage that supplies the needed security and satisfaction.

Benefits of Reliable Home Insurance Coverage

Trustworthy home insurance coverage uses a feeling of protection and protection for property owners versus financial losses and unpredicted occasions. One of the vital advantages of trustworthy home insurance coverage is the guarantee that your residential or commercial property will be covered in case of damage or damage caused by natural calamities such as floodings, fires, or storms. This insurance coverage can assist homeowners stay clear of birthing the complete expense of repair work or rebuilding, giving satisfaction and economic stability throughout difficult times.

Additionally, reliable home insurance policy policies commonly include obligation protection, which can secure homeowners from lawful and medical expenditures in the case of crashes on their building. This coverage prolongs past the physical structure of the home to protect versus suits and insurance claims that might arise from injuries endured by site visitors.

In addition, having reputable home insurance can also add to a sense of overall health, understanding that your most considerable investment is secured against various dangers. By paying normal premiums, homeowners can minimize the possible economic problem of unforeseen events, allowing them to concentrate on appreciating their homes without consistent concern regarding what might take place.

Conclusion

In conclusion, safeguarding a trustworthy home insurance policy is crucial for securing your residential property and valuables from unexpected occasions. By understanding the kinds of protection readily available, elements that influence premiums, and just how to select the appropriate policy, you can guarantee your assurance. Relying on a trustworthy home insurance copyright will supply you the benefits of economic security and security for your most important property.

Navigating the world of home insurance can be complicated, with numerous coverage alternatives, plan elements, and factors to consider to evaluate. Recognizing why home insurance coverage is essential, the kinds of insurance coverage available, and just how to choose the ideal plan can be critical in ensuring the original source your most substantial investment remains protected.Provided the value of home insurance in protecting property owners from unanticipated financial losses, it is important to understand the various types of coverage available to customize a plan that matches private demands and situations. San Diego Home Insurance. There are numerous key types of coverage offered by many home insurance coverage policies.Choosing the proper home insurance coverage policy involves cautious factor to consider of different crucial facets to make certain thorough insurance coverage tailored to private requirements and situations

Comments on “The smart Trick of San Diego Home Insurance That Nobody is Discussing”